Friends:

We’ve officially entered the second half of the 2021 mostly remote legislative session. As I reflect this weekend about what lawmakers have accomplished so far, I’m still in a state of disbelief that this work is getting done – and getting done safely – during a pandemic.

The 2020 legislative session adjourned exactly one year ago yesterday, and that’s right about when all major activities were shutting down. A few months later as we were heading into the second wave, it was clear the public health crisis wasn’t going away anytime soon. There were serious questions about whether a 2021 legislative session could even happen.

Hybrid floor session in the Washington State Senate, Jan. 13, 2021.

However, the people’s work is getting done thanks to the hard work and dedication of our legislative staff, state and local public health officials, and lawmakers who worked tirelessly to develop a mostly remote legislative session game plan.

And a special shout out goes to our legislative technology agency (LEG-TECH) for building a new IT infrastructure that made this session possible. Lawmakers would not be here passing important bills for the people of Washington if it weren’t for these highly skilled and talented women and men.

Thank you LEG-TECH!!!

Update on Bills

Last week was a key deadline for bills making their way through the legislative process. All policy bills needed to pass out of their original chamber by Tuesday to be considered further. Otherwise they’re no longer eligible for passage this session and would need to be revisited next year.

I had nine bills pass out of the Senate before this cutoff deadline. My priorities this year focus on expanding access to higher education, ending discrimination against trans and gender-fluid people in healthcare plans, increasing access to life-saving opioid overdose-reversal medication, expanding community-based banking options for local governments, prohibiting certain arbitrary local government housing limitations, and boosting media literacy and digital citizenship education in public schools.

You can learn more about my work this session on my Senate website and you can click here for a summary of all my bills that passed out of the Senate this year.

Rebalancing a Broken Tax Code

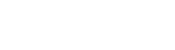

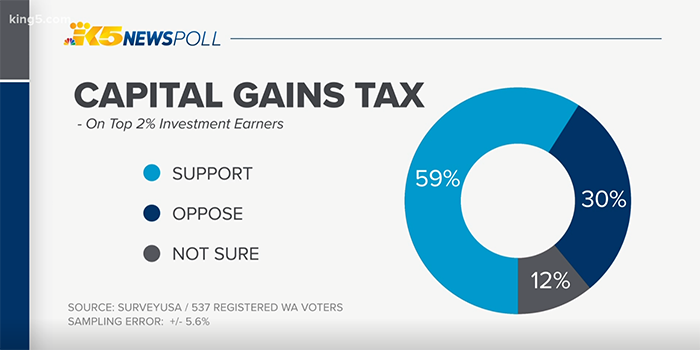

Beginning the work on fixing our broken tax code is one of the highest priorities for Senate Democrats. Our state is dead last – 50th in the nation – for having the most regressive tax code. Low-income residents pay 18 percent of their income in taxes while the wealthiest residents pay just three percent. Washington’s tax structure is the most upside down in the nation.

KUOW: Why Washington ranks as the worst state for poor residents

This has been a problem for decades, but lawmakers have finally taken a major step toward rebalancing the tax code. Last weekend, the Senate passed SB 5096, sponsored by my colleague and fellow Everett lawmaker, Sen. June Robinson.

This bill would enact a 7% excise tax on capital gains profits in excess of $250,000. Capital gains includes items like stocks and bonds, personal property, and some businesses sales if there’s a profit of more than $250,000.

There are several exemptions we built into this policy such as home sales. No one will pay a state capital gains excise tax for selling a home regardless of how much profit was made. The same goes for retirement accounts, commercial real estate, and family-owned businesses that gross less than $10 million a year. All capital gains with less than $250,000 profit will not be taxed.

You may hear from some who like to call this an income tax. This is not an income tax. This line is a scare tactic by opponents to make it sound like most Washingtonians (who earn income from regular jobs) will pay it. In reality, less than 1% of the state’s population, mostly multi-millionaires and billionaires, will pay this tax in any given year.

The revenue it generates will go toward two very important issues for millions of families: childcare and tax relief.

Save the Date: Telephone Town Hall

Sen. Marko Liias, Rep. Lillian Ortiz-Self, Rep. Strom Peterson, and Sen. Andy Billig waiting for the State of the Judiciary address. January, 16, 2019.

Thursday, March 25 at 6:05 p.m., Rep. Lillian Ortiz-Self, Rep. Strom Peterson, and I will be hosting a live telephone town hall. We’ll be giving you an update on how the session is going and answer any of your questions.

Most households in the legislative district will get a phone call from us once the event starts. If you do not get a call, you can call 877-229-8493 and enter the PIN 116357 when prompted to join the call at 6:05 p.m. on March 25.

Click here for more details, and you can also use that link to ensure you get a call from us that night.

How to reach me?

As always, your ideas are important to me. You can stay in touch several ways:

- Send me an email here or at marko.liias@leg.wa.gov.

- Call the toll-free legislative hotline at 1.800.562.6000 or 1-800.833.6388 (TTY).

- Check out my website.

- Find me on Facebook, Instagram or follow my work on Twitter.

Marko Liias

State Senator

21st Legislative District