The Washington State Wealth Tax would tax extreme wealth derived from the ownership of stocks, bonds, and other financial assets with the proceeds dedicated to education, housing, disability services, and tax credits for working families

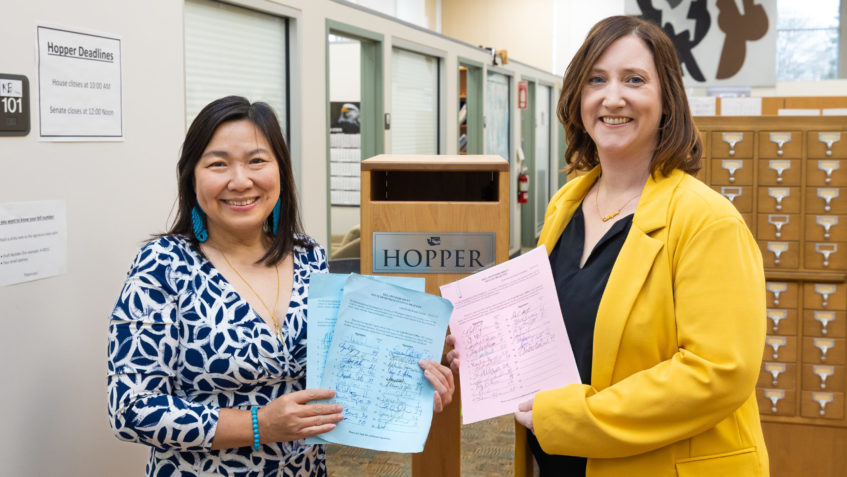

At a news conference today, Sen. Noel Frame and Rep. My-Linh Thai announced legislation to create a Washington State Wealth Tax.

The legislation would create a narrowly tailored property tax on extreme wealth derived from the ownership of stocks, bonds, and other financial assets, with the proceeds dedicated to education, housing, disability services, and tax credits for working families. The first $250 million of assessed value is exempted, meaning only the wealthiest people in Washington would pay the tax, including some of the wealthiest individuals in the world.

The bills, SB 5486 and HB 1473, were introduced simultaneously with wealth taxes in seven other states — California, Connecticut, Illinois, Hawaii, Maryland, Minnesota, and New York. The coordinated campaign demonstrates that state legislatures are leading the charge in enacting transformational policies impacting working people in their states.

“We need to fix our upside-down tax code that rewards the wealthiest few and makes it difficult for working people to pay their rent, put food on the table, and ensure their families have what they need to thrive,” said Sen. Noel Frame (D-Seattle). “This is a commonsense bill that ensures that some of the richest people in the world, some of whom live right here in Washington state, pay property taxes on their assets just like middle-class families who own a home pay taxes on theirs.”

“I know how important it is that we fight for tax justice in Washington state,” said Rep. My-Linh Thai (D-Bellevue). “It’s time we start rewarding work rather than wealth, and build an economy that works for everyone. Through this bill, we can make transformative investments in our communities and address our upside-down tax code.”

The wealth tax operates similarly to Washington’s well-established property tax on homes and real estate. By extending the property tax to include stocks, bonds, and other financial assets, the Washington State Wealth Tax ensures that extremely wealthy Washingtonians – some of the richest people in the world – are taxed on their assets just like middle-class families are already taxed on theirs.

The revenue generated is dedicated to four funds — the Education Legacy Trust Fund, which is a dedicated funding source for early learning, K-12, and higher education; the Housing Trust Fund, which pays for the construction of affordable housing; and two new funds created in the bill: a disabilities care trust account that will pay for services for Washingtonians with disabilities, and a taxpayer justice account that is intended to offer credits against taxes paid disproportionately by low-income and middle-income families.

“We know our state is facing unprecedented crises in access to affordable housing and meeting the needs of our students and our family members with disabilities,” said Frame. “The Washington State Wealth Tax will fund our future and invest in our communities.”

###