Friends –

This week marked the halfway point of the 2021 legislative session. Lawmakers are getting quite a lot done for the people of Washington in a session many weren’t sure could even happen during a pandemic. We are doing the people’s work thanks to the great efforts of legislative staff, state and local public health officials, and legislators.

Last Tuesday was a key deadline for bills making their way through the Legislature. We call it the “House of Origin Cutoff,” meaning all Senate policy bills had to pass the Senate by Tuesday for them to continue in the legislative process. Otherwise, they are considered inactive for this session and they’ll have to wait until next year to be revisited.

I’m pleased several of my top priorities this year made it past cutoff and are now over in the House.

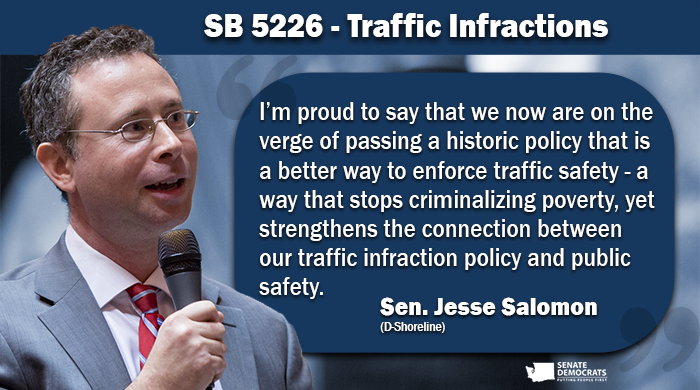

Decriminalizing Poverty

SB 5226 would take another step toward decriminalizing poverty by removing non-payment of moving violation-based traffic infractions from a list of actions that can lead to license suspensions and criminal charges for driving.

Under current law, a person is guilty of a misdemeanor if they drive while their driver’s license is suspended or revoked in the third degree. The penalty can be up to 90 days in jail, a $1,000 fine, or both. There are a number of ways one can fall into this license suspension status under current law. SB 5226 removes failure to pay an infraction from this list and instead makes any financial collections a civil matter.

Shoreline Seawalls

SB 5273 will require residential property owners to use an alternative that has the least amount of negative impact on marine life when replacing existing shoreline seawalls. Many seawalls in place now are harmful to fish habitats in the area, which then severely limits the food supply for our treasured Orca whales. We need to make sure less harmful structures are installed when existing seawalls need to be prepared or replaced.

Protecting Jobs

SB 5026 would prohibit marine ports that receive public funds from fully automating their operations for the next ten years. This will go a long way toward protecting family wage jobs at Washington’s marine ports.

Protecting Employees During a Public Health Crisis

SB 5254 would bar employers from prohibiting employees from wearing personal protective equipment (PPE) when a public health state of emergency is declared because of an infectious disease. I received reports from my district early in the pandemic that a few employers were denying the opportunity for employees to wear personal protective equipment because they were concerned that it would scare customers. I thought that was a very poor approach to public health that endangered all of us. It is reasonable to expect employers to allow employees to protect themselves and the public during this public health crisis.

Housing for School Employees

SB 5043 would give public school districts the ability to invest local levy dollars on affordable housing solutions for teachers and other school employees in their community. This bill will give school districts more tools at their disposal to recruit and retain top quality teachers.

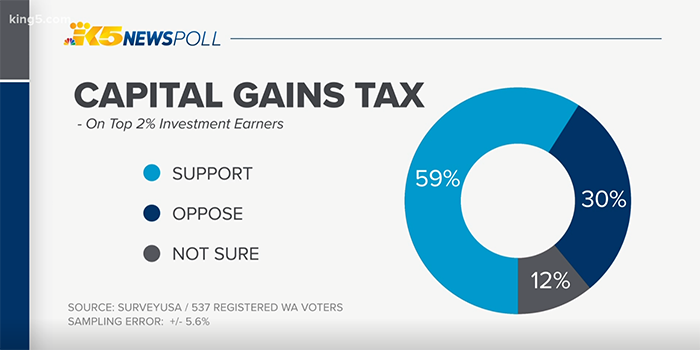

Rebalancing a Broken Tax Code

Last weekend the Senate took a major step toward rebalancing our state’s badly broken tax code. We have the most regressive taxes in the nation, with low-income residents paying 18 percent of their income in taxes while wealthiest pay just three percent. Washington’s tax structure is the most upside down in the nation.

The Senate passed SB 5096, which is a 7% excise tax on capital gains profits in excess of $250,000. This includes stocks and bonds, personal property, and some high-grossing businesses in which there’s a profit of more than $250,000.

We built in several exemptions such as home sales, retirement accounts, commercial real estate, certain family-owned small businesses, and all capital gains with less than $250,000 profit. Less than 1% of the state’s population will pay this tax in any given year.

And the revenue it generates will go toward two very important issues for me and millions of families: childcare and tax relief. It’s vitally important that all kids get a good start in life.

I invite you to watch my floor speech in support of SB 5237, the Fair Start For Kids Act, which will make childcare more affordable and accessible, expand the childcare labor workforce, and strengthen early intervention services. These investments can only be made by rebalancing our tax code.

Click on the picture below to watch my floor speech on SB 5237.

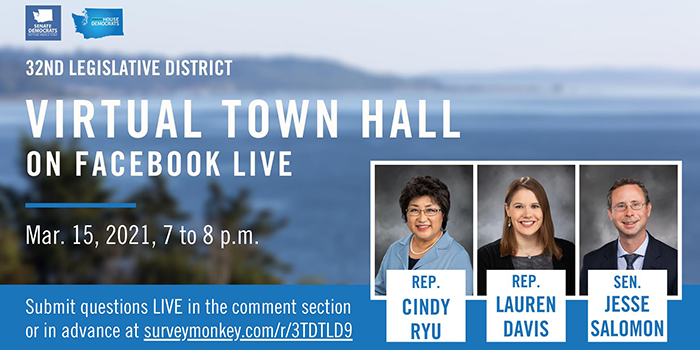

Virtual Town Hall

Be sure to tune in on Monday, March 15, 2021 from 7 – 8 p.m., Reps. Ryu, Davis, and I will answer your questions in a live virtual town hall.

You can watch and participate in the virtual town hall on several platforms:

- My Facebook Page

- Senate Democratic Caucus Facebook Page

- Senate Democratic Caucus YouTube

- Senate Democratic Caucus Twitter Feed

- House Democratic Caucus YouTube Page (Spanish language feed)

You can submit questions for us in advance with this SurveyMonkey link or send me any questions you want us to answer to: jesse.salomon@leg.wa.gov.

Sincerely,

Jesse Salomon

State Senator

32nd Legislative District