Legislation passed 48-1 today by the Senate would ensure that grants to boost the state’s salmon population cannot be subjected to sales or B&O taxes.

Senate Bill 5220 would codify that nonprofits do not need to pay sales-and-use tax on grants for salmon recovery and extend the business-and-occupation tax deduction to grants nonprofits receive from Tribal governments.

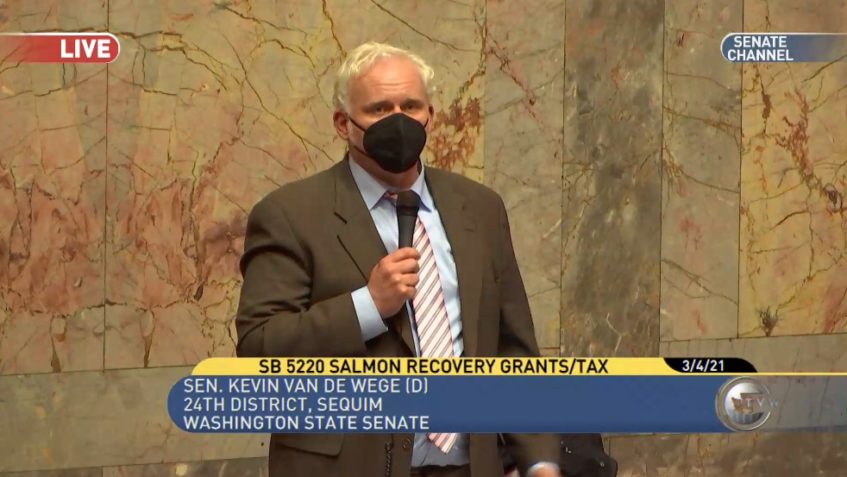

“Salmon recovery is in everyone’s best interests, and this will make sure every penny in these grants will go as far as possible,” said Sen. Kevin Van De Wege, (D-Sequim), the bill’s sponsor. “It will mean more and healthier fish, more and better jobs, healthier and happier orcas, more plentiful fishing and more tourist dollars from recreational fishing.”

Van De Wege’s legislation comes in response to the state Revenue Department’s recent determination that the retail sales tax exemption does not apply to grants from federal, state, Tribal and local governments, and that the B&O tax exemption also does not apply to these projects.

“These grants benefit the public by renewing, restoring or protecting salmon ecosystems or habitats through human intervention,” Van De Wege said. “Tax on these important publicly funded projects has not been collected in the past, and this legislation updates the state tax code to ensure that it is not collected in the future.”

The bill has an emergency clause and would take effect immediately upon being signed into law by the governor.