Dear Neighbor,

Many constituents have been asking questions about the COVID-19 pandemic and our state’s response. We are working hard to contain the pandemic, preserve public health, and get our economy back on track.

Telephone Town Hall

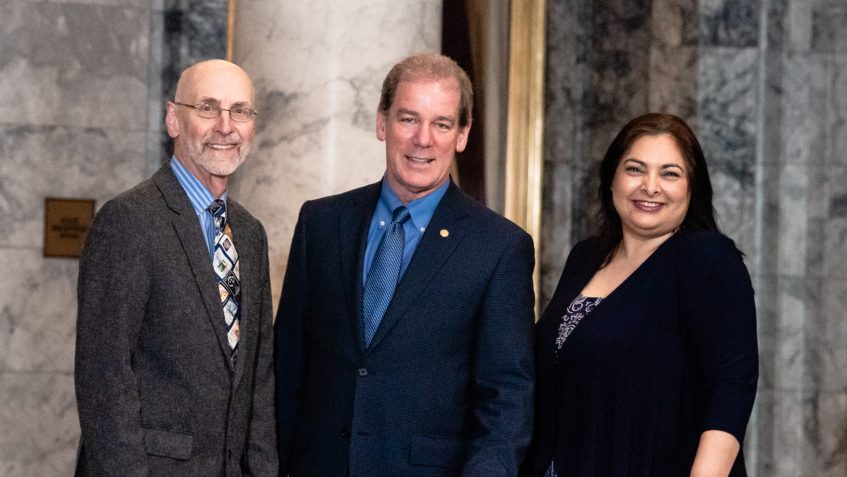

To hear answers to your questions, please join me, along with Reps. Roger Goodman and Larry Springer, on Wednesday, May 6, at 6 p.m., for a telephone town hall. We will be joined by Congresswoman Suzan DelBene and Ingrid Ulrey of Public Health — Seattle & King County.

Our automated system will call out to landlines in the district. All you have to do is accept the call and press *3 to ask questions. To ensure you are called, you can sign up here.

If you do not receive the call, you can still participate by dialing 877-229-8493 and using ID code 116292, or by going to this website.

A Quick Guide to Coronavirus Resources

The Washington State Coronavirus Response Page has links to resources for families, businesses, workers, and more. State webpages also provide information about help with taxes and health care. The state provides multilingual COVID-19 fact sheets and lists resources available for immigrant communities.

You can find countywide information at King County Public Health. In addition, county webpages provide information about emergency food access and equity and social justice resources. The United Way of King County and the Seattle Metropolitan Chamber of Commerce have additional lists of resources for people and businesses.

Eastside resources can be found at Eastside for All and (re) Startup425. Cities and local groups offer even more specific information at the following links:

45th District cities

- Duvall

- Kirkland

- Redmond

- Sammamish

- Woodinville

Neighboring cities

- Bellevue

- Bothell

- Issaquah

- Newcastle

- Mercer Island

In addition, federal information and assistance are available through U.S. Sens. Patty Murray and Maria Cantwell, U.S. Reps. Suzan DelBene, Adam Smith, and Kim Schrier, and the Center for Disease Control and Prevention (CDC).

The federal CARES Act included $17 billion for loan forgiveness for nonprofits and small businesses for certain types of loans. It also included $349 billion to create the Small Business Paycheck Protection Program (PPP), which provides subsidized loans of up to $10 million to nonprofits and small businesses with fewer than 500 employees to cover payroll, rent, mortgage and utility costs.

The Small Business Disaster Loan Program provides low-interest loans of up to $2 million to small businesses and nonprofits. And the Small Business Express Bridge Loan Pilot Program allows small businesses that currently have a business relationship with an SBA Express Lender to access up to $25,000 to bridge the gap while waiting for a decision and disbursement on a direct Disaster Loan.

Finally, you can always contact my office using the information below.

Sincerely yours,