Friends:

Following up on my last update, I want to share additional information with you about protections and resources now in place to help you with your mortgage during the public health crisis. However, please keep in mind this situation is fluid and things change rapidly. The information and resources provided below are general in nature. How they can help in individual situations may vary on a case-by-case basis.

Coronavirus.wa.gov is a great website that has a wide variety of resources located in one place. If you have been impacted by the outbreak and are looking for assistance, chances are you’ll find what you need here.

Federal protections

The federal CARES Act passed by Congress placed a foreclosure moratorium on homes with federally-backed mortgages. Homeowners with a federally-backed mortgage can request a forbearance – a pause or reduction in your monthly mortgage payments – for up to six months.

It’s important to remember that this kind of mortgage forbearance can help you in the short-term during the economic slowdown, but it does not lower the overall amount you owe on your loan. Lenders should work with you to restructure your payment options to keep you in good standing on your loan.

The U.S. Department of Housing and Urban Development (HUD) has a dedicated website with COVID-19 resources and information. Also, the Federal Housing Finance Agency has a dedicated webpage with relevant updates and resources.

Fannie Mae & Freddie Mac

The majority of home mortgages in the U.S. are financed or insured by Fannie Mae and Freddie Mac. These companies have taken steps to help homeowners during the public health crisis like offering mortgage forbearance, waiving late fees, and halting foreclosures.

Click here to find out if you have a Fannie Mae or Freddie Mac loan.

For more information:

- Fannie Mae’s COVID-19 website or call 1-800-232-6643

- Freddie Mac’s COVID-19 website or call 1-800-373-3343

State resources

Homeowners in Washington can call the Washington Homeownership Resource Center Hotline at 1-877-894-HOME (4663) for help understanding their options and to connect with a housing counselor or legal aid attorney.

This Washington State Department of Financial Institutions (DFI) webpage provides a list of financial resources for Washington consumers.

If you are at risk of facing a foreclosure, the Washington Foreclosure Mediation Program may be able to help. The program provides Washington homeowners the opportunity to be referred by a housing counselor or attorney to mediation with their lender to review available options to keep their home.

If you need to file a complaint

While many mortgage companies will work in good faith with their borrowers, some may not. If you believe your lender is not complying with the law or federal and state emergency orders, you can file a complaint with oversight agencies:

- State: Department of Financial Institutions

- State: Office of the Attorney General

- Federal: Consumer Financial Protection Bureau

Please contact me if you have any questions or need assistance during this crisis, and stay tuned for future messages as new resources become available.

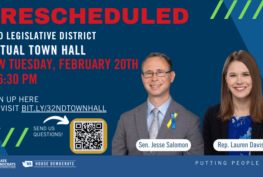

Jesse Salomon

State Senator

32nd Legislative District