Dear friends and neighbors,

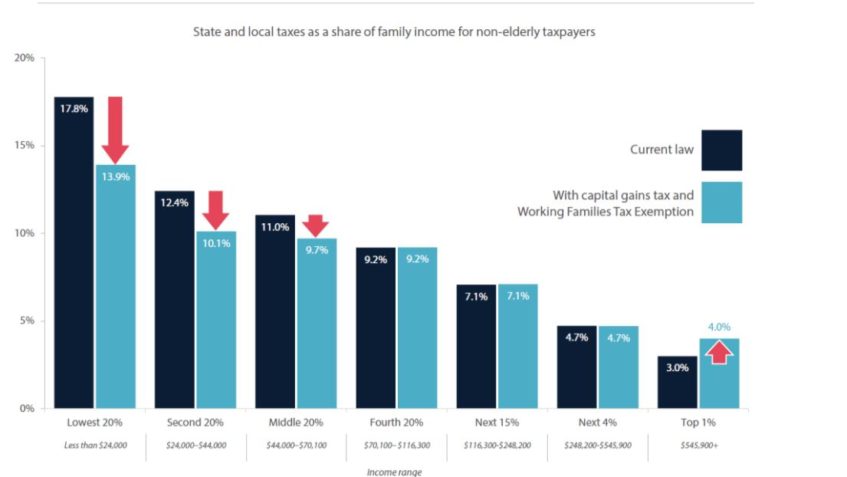

Washington has led the nation with smart policy at the state level on many issues over the years, but tax fairness isn’t one of them. For decades, tax policy experts have reported that our state has the most regressive tax structure in the United States. The state’s lowest-income residents pay six times more in state and local taxes, as a share of their income, than the state’s highest income households, which include some of the wealthiest individuals in the world. As a percentage of household income, low-income families pay nearly 18% in state and local taxes, middle-income families pay 11%, and the state’s highest-income households pay 3% or less. That means working families are funding a disproportionately high share of the programs and services communities need, while wealthy Washingtonians pay an unfairly low share.

After years of hard work by advocates and lawmakers, the Legislature finally made significant progress during this year’s legislative session with two historic pieces of legislation to help shift our tax code toward fairness.

Capital gains tax on extraordinary profits

Senate Bill 5096 will enact a capital gains tax on the very wealthiest Washingtonians. Starting in 2022, it will assess a 7.0% tax on extraordinary profits from the voluntary sale or exchange of stocks, bonds, and other high-valued capital assets. The first $250,000 in profit is exempt from the tax annually. The tax also includes exemptions for all real estate, retirement accounts, livestock, agricultural land, fishing privileges, and a qualified family-owned small business.

The Department of Revenue estimates the capital gains tax would generate approximately $500 million per year and affect approximately 7,000, or 0.2%, of all taxpayers. Obviously, folks with over $250,000 in capital gains in a single year are the wealthiest Washingtonians. Revenues collected from the capital gains tax will be deposited in the Education Legacy Trust and the Common School Construction Account, and used to fund investments in K-12 education, child care, and early learning through the Fair Start for Kids Act.

Working Families Tax Credit

The Legislature also passed HB 1297, which fulfills a promise made nearly a decade ago by funding the Working Families Tax Credit. While the policy has been law for years, it had never been funded. The tax credit will provide a financial boost to an estimated 420,000 low-income households by offering tax rebates of between $300 and $1,200, starting in 2023.

While there much more work to do, both of these policies will help Washington address the deep inequities that exist in our state’s tax code and start to deliver targeted and equitable support to the working-class households that pay more than their fair share in our upside-down tax system.

Update: Police accountability bills signed

Last week, I joined family members, community advocates, lawmakers and the governor for an event in Tacoma to sign more than dozen police accountability and justice reform bills into law. I was humbled and honored to be part of the event. Watch my remarks here or watch the full coverage here.

Thanks for taking the time to read this update. If you missed my previous updates on this year’s legislative session, click here to get caught up on what the Legislature accomplished on childcare, climate action, police accountability, and housing.

Best,

Jamie

Senator Jamie Pedersen

Jamie.Pedersen@leg.wa.gov