Dear friends and neighbors,

The Legislature is moving quickly, and we’re already on the floor passing bills. The proposals I’ve introduced are moving through the committee process – the deadline to pass most bills out of committee is Feb. 17 – and I’m looking forward to getting to pass them off the floor soon.

Fixing our upside-down tax code

As you know, one of my top priorities in the Legislature has been fixing our regressive, upside-down tax code. When I was in the House, I was able to lead those efforts as chair of the House Finance Committee, and here in the Senate, I’m continuing to do everything I can to help build a tax code that gets the wealthiest people in the world to pay what they owe, ensures working families are treated fairly under the tax code, and helps us make the investments that Washington families need in education, human services, and more.

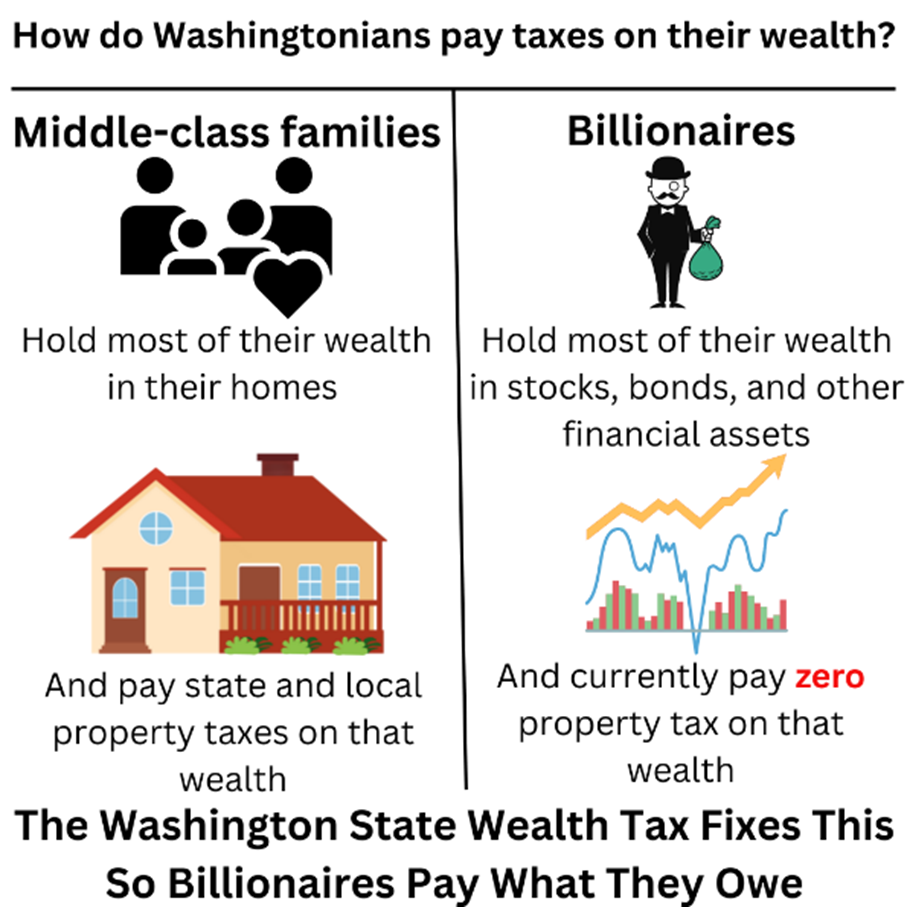

We have two big news items on this issue – first, the Washington State Wealth Tax, which I’m sponsoring as part of a coordinated campaign with seven other states: California, Connecticut, Illinois, Hawaii, Maryland, Minnesota, and New York.

The legislation would create a narrowly tailored property tax on extreme wealth derived from the ownership of stocks, bonds, and other financial assets, with the proceeds dedicated to education, housing, disability services, and tax credits for working families. The first $250 million of assessed value is exempted, meaning only the wealthiest people in Washington would pay the tax, including some of the wealthiest individuals in the world.

This is a commonsense bill that ensures that some of the richest people in the world pay property taxes on their assets just like middle-class families who own a home pay taxes on theirs.

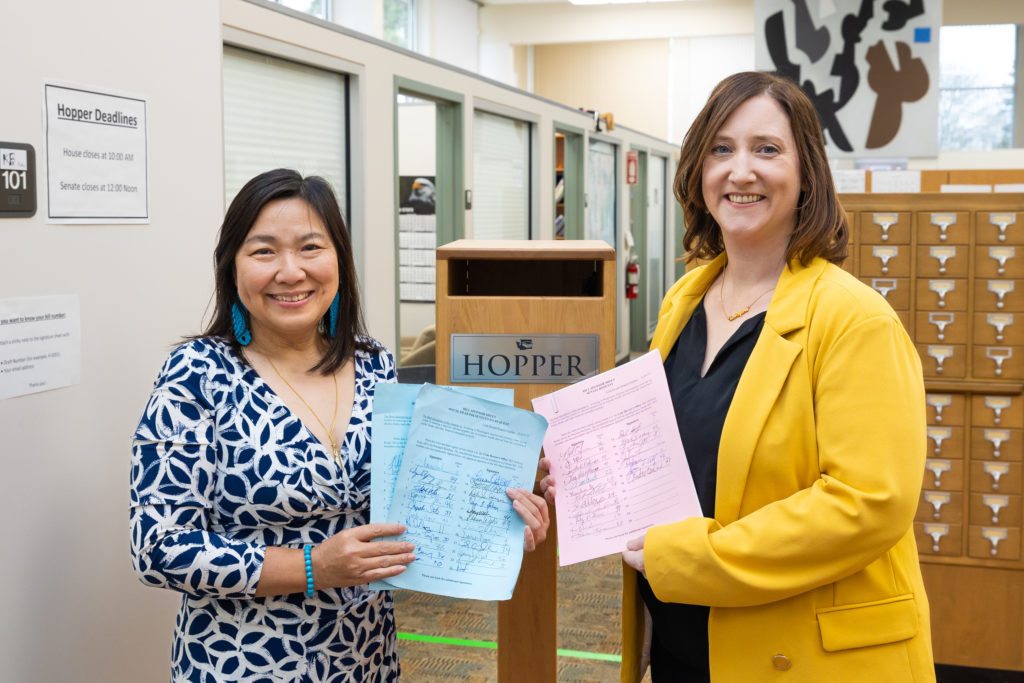

Introducing the Washington State Wealth Tax with my friend Rep. My-Linh Thai

I’ve been tremendously pleased with the response to the introduction of the proposal. One of my favorite articles was this editorial in favor by the Yakima Herald-Republic.

“Remember, this isn’t a tax on everybody. Just people with more money than they could possibly spend in a lifetime.

And imagine how that tax, multiplied by the roughly 700 people in Washington who have at least $250 million, would affect the rest of us. It’d amount to about $3 billion in additional state funds, according to an analysis by the state Department of Revenue.

Under Sen. Frame’s bill, the money would go toward education, housing, services for the disabled and tax credits for low- and middle-income families. The first $250 million of assessed value would be exempted.

Think that’d help with the state’s homeless problems? How about with our ailing hospital system? Hey, maybe our couple trying to hang onto the house they’d hoped to retire in would get a little tax relief, too.

So we say let’s give Frame’s plan some serious thought. While we certainly don’t mean to penalize anyone for being successful, the wealth gap in this country has reached epic levels of inequity.

An extra billion or so in some key state programs could be life-changing for a lot of Washingtonians without leaving a mark on the state’s first-class section.

They’d all still have at least $250 million.”

I couldn’t agree more!

The other big news is the opening of eligibility this week for the Working Families Tax Credit, a policy we passed in 2021. This new annual tax refund for Washington residents is worth up to $1,200, depending on your income level and how many children you have in your household, and more than 500,000 Washington families will qualify.

Folks can see if they qualify and apply for the credit at www.workingfamiliescredit.wa.gov

Just as we need to fix our upside-down tax code by getting billionaires to pay what they owe, we need to reduce the share of taxes lower-income folks are paying to fund our schools and communities as well, and the Working Families Tax Credit is an important part of that. I recorded a short video talking about the opening of Working Families Tax Credit eligibility – you can watch it here, and feel free to share these resources and information with your social media networks!

Your 36th District Senate team

Intern Juliet Williams, Session Aide Hannah Stockton, Sen. Noel Frame, Legislative Assistant Lyndea Kelleher

Intern Juliet Williams, Session Aide Hannah Stockton, Sen. Noel Frame, Legislative Assistant Lyndea Kelleher

I wanted to introduce some of the staff who will be working hard along with me on your behalf. Lyndea, Hannah, and Juliet are my hard-working staff who will be picking up the phone when you call our office. We’re happy to help answer your questions about legislation, take your feedback and input on a bill, or assist you if you’re having an issue with state or local government. You can always reach me at Noel.Frame@leg.wa.gov, and one of us will be in touch with you about the issue you’re concerned with.

Clergy reporting of sexual abuse

I’ve got a number of other important policy bills I’m working on, but one that’s gotten a lot of attention has to do with making members of the clergy mandatory reporters of child sexual abuse. Investigate West has done a lot of reporting on this issue, and you can read about my bill here. This is a commonsense step to help protect children and to help ensure that we have trust between faith leaders and the communities they serve.

The bill passed out of committee Thursday and I’m looking forward to seeing it become law. Stay tuned for updates!

Thanks so much for reading, and I’m looking forward to keeping in touch!

In service,

Sen. Noel Frame